Everything You Wanted to Know About Bitcoin

T he coin has go too much to ignore and so bitcoin and cryptocurrencies are dorsum in the news. Yous may have heard nigh Ethereum, a cryptocurrency that has risen in value by more than 2,500% over the course of 2017. Or possibly yous've heard most 1 of the many smaller cryptocurrencies that raised hundreds of millions of dollars in the first few days they were on auction, during their "initial money offering". Or you've just spotted that bitcoin, which made headlines in 2013 for hitting a high of $200, is at present worth well-nigh $vii,000 (£five,250), making a lot of people very rich in the procedure.

Are these cryptocurrencies simply speculative bubbles or will they actually transform our financial arrangement? It's time to answer a few common questions about this new technology – and assess whether a lot of people have just pulled off the investment of their lifetime or made a huge mistake.

What actually is bitcoin?

Bitcoin is a cryptocurrency, the beginning and nevertheless the biggest example of its type. At its core, it's a new form of digital asset, created through a canny combination of encryption (the aforementioned technology that protects WhatsApp from eavesdropping) and peer-to-peer networking (which allowed music piracy to blossom in the 00s through services such equally Kazaa).

If you own a bitcoin, what you actually control is a underground digital cardinal you can employ to prove to anyone on the network that a certain amount of bitcoin is yours.

If yous spend that bitcoin, you tell the entire network that you take transferred buying of information technology and employ the aforementioned key to prove that y'all are really yous. In that respect, your fundamental is like to a password that allows y'all admission to your money, except with no possibility of resetting your key if you lose it. Anyone else who manages to discover your key would gain total, irreversible command over your greenbacks. The history of all the transactions made is a lasting record of who owns which bitcoin: that record is called the "blockchain".

What are its advantages over money created past central banks?

Bitcoin advocates will bespeak to a number of possible advantages, from the power to utilize the blockchain to runway things other than simple money to the built-in support for "smart contracts", which execute automatically when certain weather are met.

But the biggest advantage, and the only one everybody agrees on, is that bitcoin is decentralised and so extremely resistant to censorship.

Although it's possible to discover a bitcoin payment in process, it'southward non practicably possible to stop it. That makes it radically unlike from conventional banking, where banks can, and practise, arbitrate to freeze accounts, vet payments for coin laundering or enforce regulations. That has made information technology a haven for activities from cybercrime and drug trading to enabling international payments to closed economies and supporting radically off-grid living.

So will I need to start taking bitcoin to Tesco for my weekly shop?

Unlikely. Bitcoin has one major hurdle to being used at scale for concrete transactions: payments are only confirmed once every 10 minutes (and that'due south when everything's working well; in exercise, information technology can have days for confirmation to occur). This means theoretically that information technology'south possible to spend a bitcoin, so walk next door and spend exactly the same bitcoin at a 2nd establishment. But one of those transactions will ultimately be confirmed, leaving the other identify out of pocket.

More generally, bitcoin has limited advantages for payments betwixt big companies and normal consumers. It's no easier or quicker than whatsoever other mobile payment, it introduces considerable volatility to your daily holdings (or a sizable hedging price to guard confronting swings in the value of the currency) and remains a pain to integrate with the conventional banking system.

That hasn't stopped some large companies experimenting. Microsoft accepts bitcoin for payments on its online store and PayPal offers integration for merchants to offer the cryptocurrency as a payment option.

Is it really the new golden?

Probably not, but the comparison isn't completely spurious. One of the interesting quirks of bitcoin is that there will never be more than 21m of them in being. That figure is written into the currency at its source code and is a function of how the network rewards those people who provide the calculating power (called "miners" – because of that gold illustration) that keeps information technology ticking over.

Every 10 minutes, one of the miners is rewarded with a sum of bitcoin. That reward doesn't come from anyone: it is created out of sparse air and added to the bitcoin wallet of the miner. Initially, that advantage was 50 bitcoin, but information technology gets halved every four years, until, midway through the 22nd century, the final bitcoin ever volition exist produced.

For a certain blazon of economist, that hard limit is an extremely good thing. If you believe that the cardinal problem with the financial organisation over the past 100 years has been that primal banks print coin, creating aggrandizement in the procedure, and so bitcoin provides an alternative ecosystem where inflation is capped forever.

Does it really create more carbon dioxide than Ecuador?

Yup. And and then some. Citibank estimates that the bitcoin network volition somewhen consume roughly the same amount of electricity every bit Japan. The trouble is that the mining procedure is incredibly wasteful – and deliberately so. Those miners are all competing to be the commencement to solve an arbitrarily hard computing problem, 1 that takes enormous amounts of processor cycles to do and still comes down mostly to luck. The computer that does solve it first, every 10 minutes, gets a sizable reward – currently in the region of £65,000 in bitcoin – but every figurer, not merely the winner, has had to spend that processing time to do the maths.

The reason for the mining requirement, which is essentially asking a computer to go along rolling a dice until it rolls a few thou sixes in a row, is that it ensures that no unmarried person tin dictate what happens on the network. The proof that the miner has solved the trouble is what information technology uses to merits its reward, merely it too becomes the seal that it uses to verify the final 10 minutes of transactions.

"I, miner number 2357398, have solved this problem, and the answer is [extremely long cord of digits]. By the authorisation vested in me by the network, I declare that the following list of transactions to exist confirmed:" and then they list every transaction that they have heard nigh in the final ten minutes.

From that point on, every machine on the network begins solving a new problem, gear up by the terminal miner. But, crucially, they merely do and then if they agree with the miner'due south list of transactions. That means that even if y'all do win the race, it's non enough to just insert your own lies in the block, and declare that anybody sent you all their money, because everyone else will simply ignore you and mind to the adjacent miner in the chain.

(The reward itself isn't really necessary to Bitcoin, but it's there to ensure that miners have some reason to throw their electricity at the network. In the long-run, the hope is that voluntary transaction fees for quicker confirmations volition take over that role.)Considering the problem is and then processor-intensive and so randomly rewarded, information technology's prohibitively expensive – in electricity and computing ability – to attempt to imitation it. But it'due south also a vast use of electricity, worldwide, used to do little other than satisfy an arbitrary requirement for spending money.

Is bitcoin the only cryptocurrency?

Not at all, although information technology'south nevertheless the almost valuable. Later on bitcoin's creation in 2009, a number of other cryptocurrencies sought to replicate its success by taking its free, public lawmaking and tweaking it for different purposes.

Some had a very defined goal. Filecoin aims to produce a sort of decentralised Dropbox; too every bit just telling the network that you have some Filecoins, you lot can tell it to store some encrypted data and pay Filecoins to whoever stores it on their computer.Why would you want that? Well, it again comes back to censorship resistance. If yous shop something on your Dropbox that the visitor doesn't similar, it tin can just delete the information and ban you. With Filecoin, it's incommunicable to tell what's being stored, and incommunicable to strength the network to block whatever given user anyhow.

Others are more nebulous. Ethereum, now the second biggest name after bitcoin, is essentially a cryptocurrency for making cryptocurrencies. Users can write "smart contracts", effectively programs that can be run on the figurer of any user of the network if they're paid enough Ether tokens.Recollect, for instance, of offering a small sum every time someone responds to a particular signal with today's headlines: yous've built a decentralised news website, and then. Or you could write a minor program and advantage someone every time it'south run: that manner, y'all've created a decentralised cloud figurer.

As a category, these new cryptocurrencies are increasingly referred to as "decentralised apps", or "dapps", with the focus beingness not on the specific currency used to make the system piece of work, but on its overall goal.Information technology might fifty-fifty exist best non to remember of the coins that prevarication at their heart equally "currency" at all: when the token could represent a services contract, a country registry record, or the right to v minutes of calculating time, the analogy to pounds and dollars has rather broken down.

What is driving the toll rise?

That's the billion-dollar question. A few unlike explanations have been offered.

Some fans will say that the cost ascension is merely a correction to the natural rate of growth for bitcoin. Certain, they argue, the applied science has had its booms and its busts, simply if it is to become a worldwide digital currency, its value will definitely be higher than it is today. In that narrative, the price ascent is simply a reflection of the growing acceptance of bitcoin.

Other fans betoken to the growth in novel cryptocurrencies. Because of bitcoin's maturity, and its focus on finance, if you want to purchase some Ether, some Filecoins or any other cryptocurrency, it's normally easiest to purchase bitcoin with your conventional currency and then trade bitcoin for the cryptocurrency of your selection. Naturally, and so, booms in those currencies are leading to booms in bitcoin itself, as more and more people endeavor to buy into the whole system.

Then there's the chimera argument. At that place, people argue that the majority of the price rise is due simply to people buying bitcoin in the hope that they can sell it later for a profit. A classic speculative bubble, some people will brand a lot of money – while others will lose everything.

So is information technology a bubble?

Few would fence that there isn't a lot of speculation in the cryptocurrency marketplace. There are adverts on the London underground, and all over Instagram and Facebook, encouraging viewers to "invest in cryptocurrencies" and, judging by the amount of money flowing in to the ecosystem, a lot of people are taking up the offering.

At some signal, those people volition get flighty and try to cash out their gains. If enough exercise at once, the price of bitcoin volition take such a tumble that information technology will prompt a run and we'll see the classic crash.

But the real question is not whether this will happen, but when – and how big the crash is. Three times now, bitcoin has had boom-and-bust cycles that accept seen vast amounts of value destroyed, but have still left the currency valued college than information technology was before the previous boom began. (Personally, I start chosen bitcoin a "chimera" in print when one coin was worth $30. After the crash that followed, one coin was worth $120.) It's non a polish ride upwardly, simply that doesn't mean it's a total bubble.

What is a "hard fork"?

As the bitcoin network has grown, information technology's hitting problems. For ho-hum, technical reasons, the network equally information technology was initially designed struggles to bargain with the amount of traffic that flows through it these days, leaving huge delays in the amount of fourth dimension information technology takes for a transaction to exist confirmed.

In a normal, centralised, business, that wouldn't exist a problem: simply update the software and move on. But a bitcoin update requires convincing every single miner to accept the new software – otherwise, the miners who carry on running the old version are effectively running a completely different currency from those who have updated.

This is known as a "hard fork", and for the first six years of bitcoin's life, it was the nightmare every programmer tried to avoid. Only recently, divisions among the customs have get so fractious that multiple hard forks have occurred, all around how to deal with this traffic slowdown.

With names like Bitcoin Classic, Bitcoin Unlimited, and Bitcoin Golden, each claims that it is the true heir to the original vision – but with each fork, the playing field becomes more crowded.

Nothing is destroyed with each fork: if you had 100 bitcoin before Bitcoin Cash split off, later the split you lot still had 100 bitcoin and you had 100 Bitcoin Greenbacks. But with each fork, the playing field becomes more crowded, more disruptive for newcomers, and the overall reputation for (relative) stability becomes more than eroded. Some other fork, SegWit2x, was due to happen in belatedly Nov, but its backers decided at the last minute information technology didn't have enough support and called information technology off.

What's the banking establishment's view of bitcoin?

It varies profoundly. Some, such as JP Morgan Chase head, Jamie Dimon, are extremely dismissive of the whole thing, arguing that the very properties of bitcoin that get in and so appealing every bit a grade of digital gold are why it'due south doomed to remain a niche prospect. For Dimon and co, the volatility of its exchange rate, lack of whatever economic oversight to control budgetary policy and absenteeism of back up from major nation states mean bitcoin tin can't always truly replace pounds and dollars and is therefore a failure.

Few disagree with that decision, only some bankers point to other advantages of the applied science. The blockchain concept, they say, might be useful in conventional banking too. Forget bitcoin itself and focus instead on the value of a "distributed ledger". What if all the major banks replaced their normal book-keeping with i shared, but still closed, database? Might that help cut down on fraud and ensure a more level playing field?

And then, of grade, there are the advantages of bitcoin that conventional banking can't hope to compete with - and doesn't desire to. Can a shadow currency be purely on the back of drug dealing and cybercrime? Quite perhaps: both are big businesses, and neither shows any sign of going away.

What's the latest on the identity of Satoshi Nakamoto?

He'due south however a mystery. The pseudonymous founder of bitcoin, Nakamoto appeared out of nowhere in 2008 when he published the white newspaper that described how his proposed digital currency would work. While he was agile in the online community effectually bitcoin for the first couple of years of the currency's life, he posted less and less, making his concluding ever post on 12 December 2010.

Since then, a lot of people have been accused past others of beingness the existent identity behind Nakamoto. Some of those accusations have been farcical – Newsweek fingered a Japanese-American human named Dorian Satoshi Nakamoto equally the inventor, leading to a tedious-motility car chase around LA before the man had a sushi dinner with i hand-picked reporter, during which he repeatedly referred to "bitcom" and begged to be left alone.

Others have been based on the background discussion around cryptocurrencies at the time: leading thinkers such as Hal Finney and Nick Szabo were named, on the basis of similar areas of research. Both men denied being Nakamoto and pointed out that they were active under their ain names at the time bitcoin was launched, with Finney (who died in 2014) being the currency's second‑ever user.

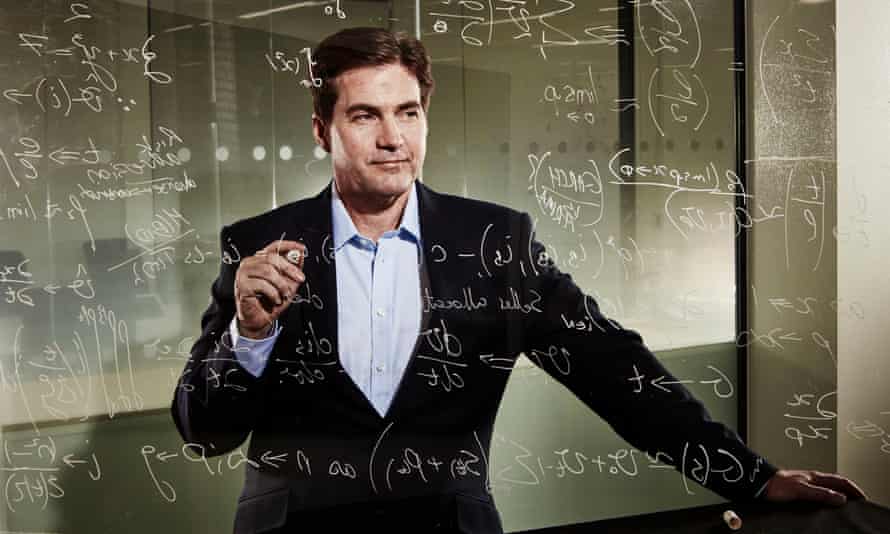

Just ane person has credibly claimed to be Nakamoto himself: Australian estimator scientist Craig Wright. In 2016, Wright went public and gave a number of long interviews to the BBC, GQ, the Economist and London Review of Books, in which he claimed that he would provide evidence proving he is Nakamoto. When the evidence was released, nonetheless, information technology was flawed, proving cipher and leading some to accuse him of "scammery".

Since then, there take been no other major names linked to Nakamoto's identity and no action on the bitcoin holdings linked to his account, currently worth around $7bn. Information technology is possible the globe may never know who invented bitcoin. For many in the field, that'due south how it should be.

villanuevafrompeat1957.blogspot.com

Source: https://www.theguardian.com/technology/2017/nov/11/everything-you-ever-wanted-to-know-about-bitcoin-but-were-to-afraid-to-ask-cryptocurrencies

0 Response to "Everything You Wanted to Know About Bitcoin"

Postar um comentário